Urban

Acting in shopping malls, offices, industrial and residential.

Click and see some of our successful cases in this area:

Services

![]()

Cases

![]()

Riverside Shopping Center – Pelotas, RS

Feasibility study and architectural design for the remodeling of a meat packing plant into a shopping center and sale during construction to an investor.

Vila Romana – São Paulo, SP

Analysis and valuation of the development potential of this old industrial site in a densely populated urban area projecting up to 4 buildings of 24 floors each. Area 11,000 m².

São José dos Campos, SP

Valuation and feasibility study for a large strategically placed site in a densely populated area close to the city center, but with restrictive zoning currently in place. Area 59 hectares.

Fazenda Santa Maria – Amparo, SP

Market and feasibility studies to determine the development potential for large scale residential development of both first and second homes, to include an existing hotel and golf course. Area 155 hectares.

Hacienda Guataparo – Valencia, Venezuela

Market and feasibility studies, conceptual master plan and preparation of development strategies for the urban expansion of Valencia. Area 17,000 hectares.

Mouraville – Itu, SP

Coordination of studies for the revision of a master plan, market studies, feasibility studies and preparation of business plan. The development plan including 896 residences, Shopping Mall, 3 golf courses, Equestrian center, Tennis club and Hotel. Area 620 hectares.

Uberlândia, MG

Market and feasibility studies and conceptual master plan for residential and commercial uses. Area 335 hectares.

Nova Lima, MG

Market and feasibility studies and conceptual master plan for residential and commercial uses. Area 25 hectares.

Condomínio Esmeraldas – Belo Horizonte, MG

Market studies, Feasibility studies and consultation on the master plan for a condominium with hotel, 2,300 residences and equestrian center. Area 154 hectares.

Santa Isabel, SP

Best use study identifying low cost residential development as being the most profitable use of this hilly area located between the town and a major highway. Area 46 hectares.

Porto Alegre, RS

Valuation of a house with a 984 m² site and 523 m² of built area and development potential, for a foreign institutional client.

Mangels – São Bernardo do Campo, SP

Valuation of a large industrial plant with additional analysis of redevelopment potential in view of restrictive zoning. Area: Land 100,000m² Built 35,000m².

Sítio dos Morros – São Bernardo dos Campos, SP

Valuation and preparation on initial master plan and feasibility analysis for the development of a distribution park on this extremely strategically located property. Land Area 500,000m².

Industrial Plant – Porto Alegre, RS

Valuation of property. Areas: Land 68,200m² Built 9,800m².

Paccar – Ponta Grossa, PR

Valuation and due diligence analysis of three rural properties being contemplated for acquisition. The subsequent negotiation with the landowners and assistance in the eventual purchase of these areas for the establishment of the first DAF truck plant in the country. Discussions and agreement with the municipal authorities on zoning changes required. Area 890 hectares.

M&G – Suape, PE

Due diligence physical inspection of the land and buildings of this major industrial plant. Area: Land 853,000m² Built 40,000m².

Quebecor – Suape, PE

Valuation of this large modern industrial plant adjacent to a large port complex. Areas: Land 60,000 m² Built 15,000m².

Sanofi – Campinas, SP

Valuation of both capital and rental values of this property fronting a major highway. Area: Land 4,265 Built 2,844m².

Alcan – São Paulo, SP

Preparing a relocation study, identifying the main factors impacting on a move of their plant from an overcrowded central location to a newer industrial area. Working with management developing a matrix approach to identifying the critical elements to be considered and evaluating the alternatives against this matrix.

Jaguariuna, SP

Market studies and feasibility studies on a strategically located industrial and distribution site fronting a major highway, demonstrating the potential for development. Land Area 111 hectares.

Gravatai, RS

Valuation of Industrial Building. Areas: Land 56,000m² Built 9,800 m².

Valinhos, SP

Valuation and sale of industrial building of 5,540 m² on land of 16,400 m².

Av. João Dias – São Paulo, SP

Valuation and best use analysis of this ageing furniture factory identification of potential occupiers and sale for conversion to a university. Area: Land 16,000 m², built 5,570 m².

Avenida Indianópolis – São Paulo, SP

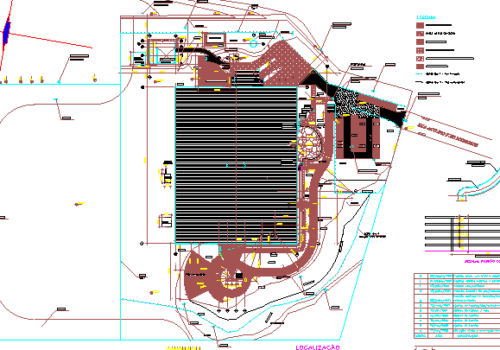

Purchase of site, best-use feasibility studies, preparation of architectural plans, construction management, leasing and property management and the eventual leasing and sale of investment to General Motors. Area 12,000 m² offices.

Edifício São Luiz – Avenida Paulista, São Paulo, SP

Auditing of the planning and construction of this prime office building on behalf of the Jesuit Congregation, owner of the freehold. Area 64,000m².

Itaim Bibi – São Paulo, SP

Feasibility study of a property for redevelopment purposes. Site area: 608 m².

Rio de Janeiro, RJ

Project management, leasing and sale to investor of a 10,555 m² building on Flamengo Beach.

Reserva do Paiva – Cabo de Santo Agostinho – Recife, PE

Evaluation of building with 14,420 m² for a foreign institutional client.

Cultura Inglesa – Butantã, SP

The selection and purchase of a site, the preparation of plans and management of the construction of this language school. Area: Land 1,760m² built 1,750m².

Cultura Inglesa – Vila Mariana, SP

The selection and purchase of a site, the preparation of plans and management of the construction of this language school. Area: Land 1,250m² built 2,400m².

Cultura Inglesa Mooca

The selection and purchase of a site, the preparation of plans and management of the construction of this language school. Area: Land 2,300m² built 2,200m².

Porto Alegre, RS

Valuation of a commercial property of 7,078 m² for conversion into offices, for a foreign institutional client.

Shopping Center Guararapes – Recife, PE

Valuation and consultancy for the structuring of an Investment Fund and monthly auditing of the operational results of this shopping center which was the sole asset of this fund.

Baymarket – Niterói, RJ

Pre-Operational feasibility Study and Post operational Valuation.

Pátio Brasil Shopping – Brasília, DF

Valuation and Consulting to the Sonae Group of this Shopping Center included in the portfolio on takeover by them of the holding company owner.

Tivoli Shopping – Santa Bárbara d’Oeste, SP

Valuation.

Bairro Monte Alegre – Piracicaba, SP

Vocation study of a listed property located next to the urban revitalization Project of the Monte Alegre plant, in Piracicaba, SP. Aiming at better use of the land with a hotel, using the listed property as a reception, convention center and auxiliary areas of the future development. Land area: 9,700 m².

Franca, SP

Valuation and Consulting to Sonae of this Shopping Center included in the portfolio on takeover by them of the holding company owner.

Santo André, SP

Valuation and Consulting to Sonae of this Shopping Center included in the portfolio on takeover by them of the holding company owner.

Penha, SP

Valuation and Consulting to Sonae of this Shopping Center included in the portfolio on takeover by them of the holding company owner.

Manaira Shopping Center – João Pessoa, PB

Valuation of this privately-owned development.

Montevideo, Uruguay

Valuation of a foreign Embassy.

Rio de Janeiro

Valuation of 30,000 m² site for a foreign consulate.